Are you a small business owner and considering getting a public liability insurance (PLI) policy? Then this post is for you. In this article, we will discuss why having public liability insurance is important, the types of public liability insurances available and the list of businesses that need this type of insurance.

If you’re dealing with the public or clients, then it is recommended to have a public liability insurance policy.

Related: Create a manufacturing website in 5 steps

5 businesses that need public liability insurance

Without insurance, the businesses below risk the chance of a single lawsuit bankrupting them.

- Chemicals manufacturing businesses.

- Restaurants.

- Contractors.

- Hospitals.

- Schools and colleges.

Before we discuss each of these five businesses, let’s explain what public liability insurance is. We’ll close with tips on how to find a reputable insurance provider.

What is public liability insurance?

Public liability insurance policy protects businesses and their owners from the risk of being sued for any bodily injury or property damage that occurs on their business premises.

Public liability insurance covers the defence cost and any legal pay-out that the insured might be held accountable for.

For example, if you have organized an event and a public member gets hurt in your premises, the public liability insurance will cover all legal costs that incur and any claims made by the injured.

What’s covered in a public liability insurance policy:

- Bodily injury

- Property damage

- Legal expenses

- Claim’s cost

What’s not included in the policy:

- Loss of reputation or defamation

- Mental loss

- Employee injury/accident

If you want more coverage you can go for the general liability insurance (GLI). GLI covers a broader range of people — vendors, employees and also the business owner — against such risks.

Related: Domain names list for manufacturers

These 5 businesses need public liability insurance

Let’s discuss some businesses that definitely need public liability insurance:

1. Chemicals manufacturing businesses

After the Bhopal tragedy in 1984, the government made it compulsory for any business that deals in a hazardous environment to take the public liability policy.

Under the Public Liability Insurance Act, 1991, it is mandatory for you to take the PLI cover to safeguard yourself from the claims due to mishaps and harm caused to the public.

2. Restaurants

Public liability insurance is a building block for any restaurant business.

PLI protects the restaurants from the costs incurred due to damages. A few likely situations include accidental spilling of hot food, falling cutlery or slippery floors. It also protects the business if a customer seeks damages for alleged food poisoning.

3. Contractors

You must take public liability insurance if you are in a business of undertaking contract work on customer’s site like:

- Construction

- Plumbing

- Electrical work

The insurance will protect you from any claim that is made against you for any damage to the customer’s equipment, property or injuries to a person while you are working there.

4. Hospitals

Hospital is another business that is prone to the risk of getting sued due to property damage or personal injury that occurs during the course of their business operations.

In this case, PLI does not cover any injury or death caused by the negligence of the doctor. For such risk, professional indemnity insurance cover is required for the doctors.

5. Schools and colleges

Suppose a fire breaks out in your school/college premises due to which few students get injured — PLI can cover the financial cost of defending your case in the court and paying any claims made by the students.

Types of public liability insurances

There are two types of public liability insurance made for different types of businesses.

Public liability policy (industrial risk)

This type of insurance is provided for:

- Manufacturing units

- Warehouses

- Godowns

In the business that involves the usage of big premises, heavy machinery, and raw materials, the risk of anyone getting injured is very high. Such risk is covered under this policy.

Public liability policy (non-industrial risk)

Even if you have a non-industrial type of business, you and your business are still prone to claims arising due to mishaps or sudden risk.

Therefore, this type of insurance policy is meant for non-manufacturing businesses like:

- Schools

- IT companies

- BPOs

- Restaurants

- Hospitals

Consult an insurance agent about the policy that’s right for your business.

How to find a reputable insurance firm

You can find many insurance companies providing public liability insurance in India, but choosing the best one is not easy if you don’t know the criterion on which you must compare.

1. Background research

In India, you can buy an insurance policy online as well as offline. Either way, you must do extensive research on all the players in that niche. Google their names and visit their websites.

Look for established brands that are big enough to pay your claims in case the situation arises.

2. Coverage

Different companies offer different coverages. You must make sure that risks related to your business are covered by the policy.

If you want to cover more business-related risks, then check and compare the various extensions they provide with the main policy.

3. Price

Once you’ve shortlisted a couple of insurance providers, ask them for the quotations.

The premium you need to pay is decided based on several factors including the nature of your work and business, the risk involved in the business, your experience in the business and so on.

4. Claim settlement history

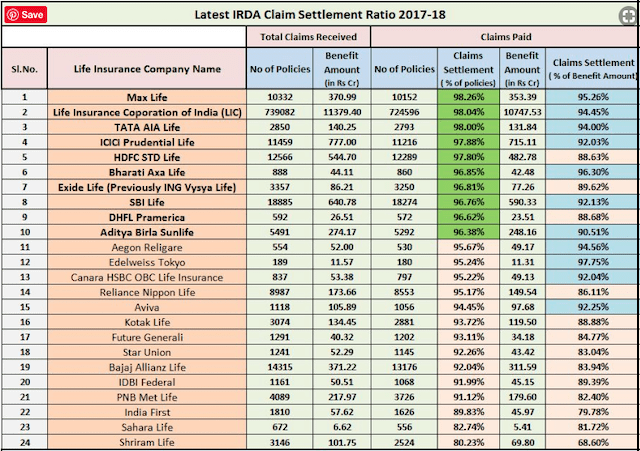

Website of Insurance Regulatory and Development Authority of India (IRDAI) hosts important information related to various insurance providers, including each company’s claim settlement ratio.

Claim settlement ratio is the ratio of the number of claims approved by the insurer compared to the number of claims received by them. The higher the ratio, the better for you.

While you should necessarily consider the claim settlement ratio while finalizing your insurer, it is not the only factor.

Cost of premium, optional riders, quality of service and your confidence in the brand are other major factors.

5. Reviews

The truth is, it’s hard to find honest reviews. You will never find a critical or bad review on the website of any company. Any bad review online can be a competitor’s tactic too.

The best feedback comes from friends and family. Look for acquaintances who have gone for such types of insurance and know their experiences.

Conclusion

We have discussed the list of common businesses that need public liability insurance but it is not an exhaustive list.

If your business deals with clients, employees or members of the public then you must take public liability insurance.

Choosing a good insurer and the best policy that covers your business in all respects takes time and a little effort. Once chosen, you will have an insurance agent by your side to guide you with his expertise and experience.

The above content should not be construed as legal or insurance advice. Always consult an attorney or insurance professional regarding your specific situation.

The post 5 businesses that need public liability insurance in India appeared first on Blog.

0 Comments